Auto Insurance in and around Greenville

Greenville's top choice for car insurance

Take a drive, safely

Would you like to create a personalized auto quote?

State Farm Has Coverages For Your Needs

Everyone knows that State Farm has outstanding auto insurance. From pickup trucks to SUVs scooters to motorcycles, we offer a wide variety of coverages.

Greenville's top choice for car insurance

Take a drive, safely

Great Coverage For Every Insurable Vehicle

Your vehicle will thank you for making sure you're prepared with State Farm insurance. This can look like emergency road service coverage, liability coverage and/or collision coverage, and more. That's not all! There are also a variety of savings options including an older vehicle passive restraint safety feature discount, the good driver discount and an anti-theft discount.

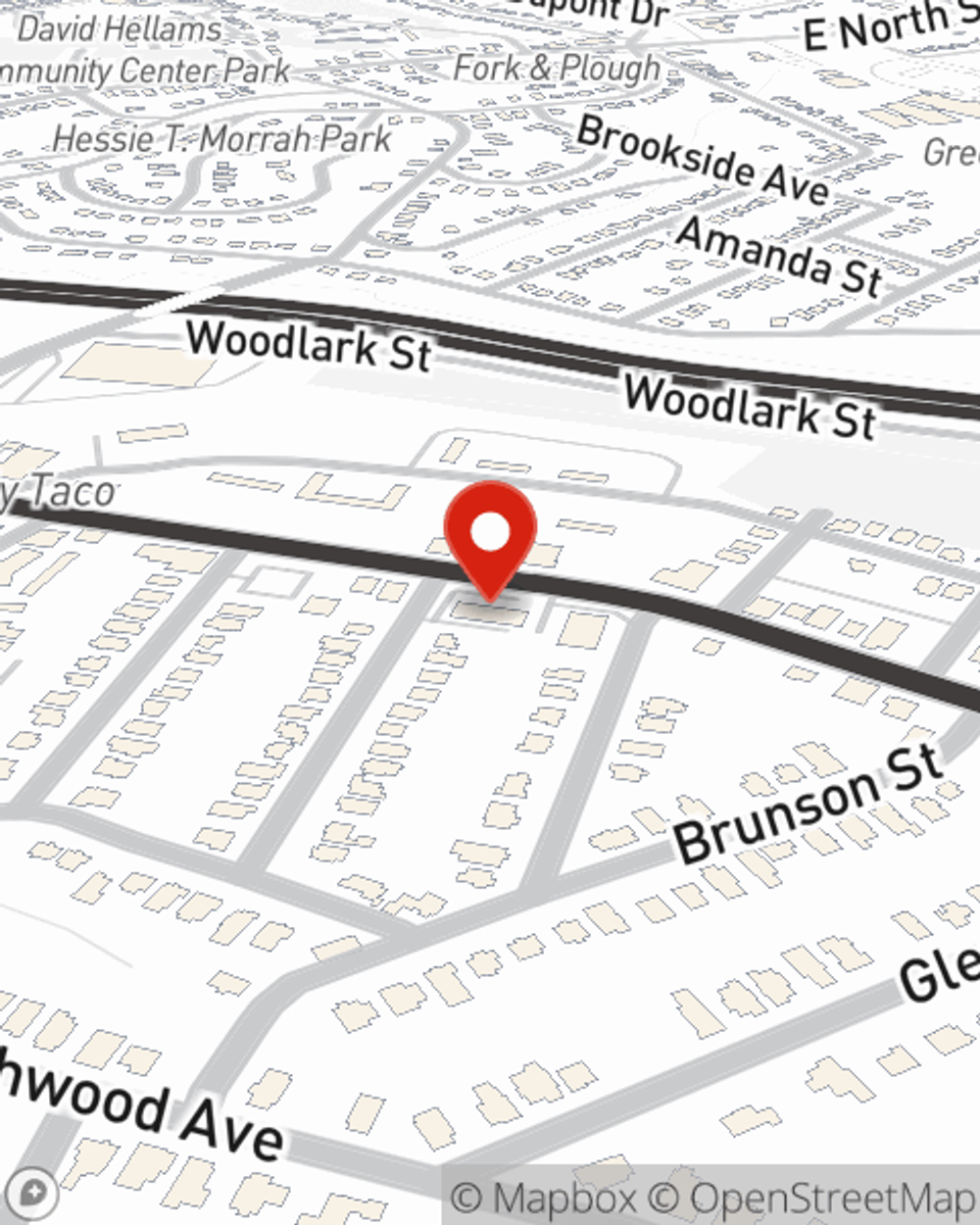

Greenville drivers, are you ready to learn more about what the largest auto insurer in the United States can do for you? Call or email State Farm Agent Parker Smith today.

Have More Questions About Auto Insurance?

Call Parker at (864) 990-2739 or visit our FAQ page.

Simple Insights®

Car battery maintenance and replacement tips

Car battery maintenance and replacement tips

Have you checked your vehicle's battery? Read this article to learn all about your battery and when to replace it.

Camping safety made simple

Camping safety made simple

A camping trip is a great way to get in touch with nature. Setup your campsite & secure your belongings with the help of these camping safety tips.

Parker Smith

State Farm® Insurance AgentSimple Insights®

Car battery maintenance and replacement tips

Car battery maintenance and replacement tips

Have you checked your vehicle's battery? Read this article to learn all about your battery and when to replace it.

Camping safety made simple

Camping safety made simple

A camping trip is a great way to get in touch with nature. Setup your campsite & secure your belongings with the help of these camping safety tips.