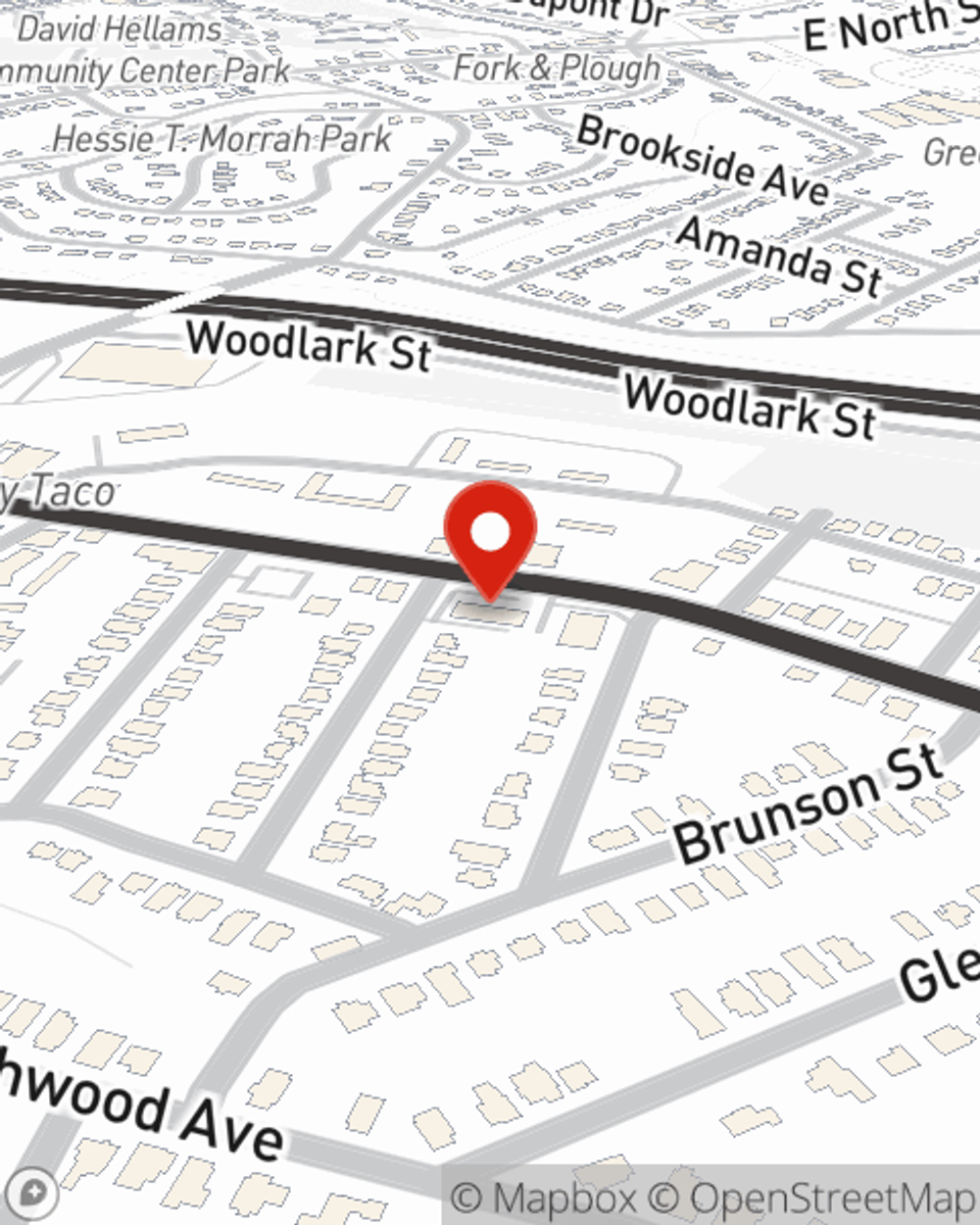

Business Insurance in and around Greenville

Greenville! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Your Search For Excellent Small Business Insurance Ends Now.

When you're a business owner, there's so much to focus on. You're in good company. State Farm agent Parker Smith is a business owner, too. Let Parker Smith help you make sure that your business is properly insured. You won't regret it!

Greenville! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Strictly Business With State Farm

For your small business, whether it's an auto parts shop, a bagel shop, a bridal shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, extra expense, and accounts receivable.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Reach out to State Farm agent Parker Smith's team today to explore the options that may be right for you.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Parker Smith

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.